Essential Online CPA Services for Startup Success

Introduction: Key to a Startup’s Financial Health

The Rising Importance of Online CPA Services

In today’s online startup landscape, speed and financial acumen are central to a startup’s survival. Finding the best Online CPA services is not just a modern convenience; it can be the difference between successful cash flow management and bankruptcy. They offer a blend of expertise and convenience that allows for seamless financial management amidst a fast-paced market. As startups grapple with the demands of growth, these services become pivotal in charting a course towards survival and more important, profitability.

Dearth of Available CPA’s Working with Startups

According to the AICPA, the accounting profession is facing a severe crisis due to a shortage of accountants. As this trend continues into the 2020’s fewer students select accounting as a major. As a direct result of enrollment declines in accounting programs, candidates sitting for the CPA exam have also decreased from 48,004 first-time candidates in 2016 to 32,188 in 2021, a 33% drop.

Consider the below startling statistics:

- The

- As

- Al

Tailored Accounting Solutions for the Modern Startup

CPA working with client

Tax, Bookkeeping & Accounting for Business Operations

Dive into the world of tailored tax, bookkeeping, and accounting services, and you’ll see how they are not one-size-fits-all—especially for startups where agility is key. Startups thrive on bespoke solutions that mesh seamlessly with their unique operations and goals. An online CPA can provide just that, whether it’s maximizing tax benefits, keeping books up-to-date, or offering strategic financial advice. The right partnership ensures that financial operations are as nimble and dynamic as the startups they support, allowing you to adapt quickly to market changes and investment opportunities.

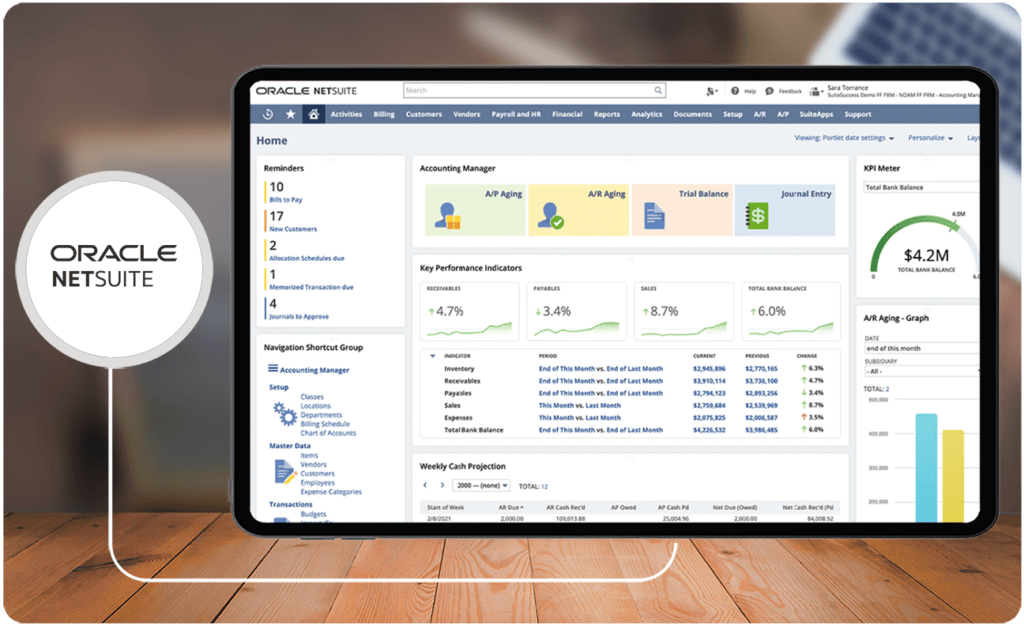

Cutting-Edge Tools and Platforms for Real-Time Financial Insights

Leveraging cutting-edge tools and platforms, online CPA services offer startups the prowess to gain real-time financial insights. With financial dashboards, analytics, and reporting tools at their fingertips, startups can make on-the-fly decisions that impact spending, saving, and long-term financial planning. These platforms are designed to not only present data but to also provide actionable insights—critical ammunition for a business in its formative years. Startups can expect to see performance metrics, budget vs actual analyses, and cash flow forecasts that are indispensable for strategic decision-making.

The Perks of Partnering with Online Startup CPAs

Personalized Attention for Your Unique Needs

When you partner with an online CPA service, you’re not just another account on their ledger; you’re the captain of your own financial ship, and they’re the skilled navigator. They offer personalized attention to understand the minute details of your business model, industry nuances, and the ambitions that drive your startup. This level of customized support ensures that every financial strategy is tailored to your startup’s unique needs, helping you steer clear of generic advice that misses the mark. Regular check-ins and unlimited async support mean that as your needs evolve, your CPA’s approach evolves with you, cementing a proactive partnership dedicated to your success.

Tech-Savviness Meets Traditional Expertise

The fusion of tech-savviness with traditional financial expertise marks the dawn of a new era in accounting services. Online CPAs bring a deep understanding of age-old accounting principles, now enhanced by technology to deliver optimal results for your startup. They wield tech tools with finesse, from automating mundane tasks to integrating financial software into your existing systems, all while upholding the integrity of proven accounting practices. It’s this blend of the old and new that assures you get the best of both worlds—reliable expertise and innovative solutions that keep your finances at the cutting edge.

Lower Cost versus Traditional Accounting firms

The cost savings of online CPA services compared to traditional firms can be a game changer for your startup. Without the overhead of a brick-and-mortar office, these modern firms often pass on the savings to you through competitive pricing while still offering top-notch services. Plus, their scalable solutions mean that you only pay for what you need, when you need it, avoiding the trap of expensive, unused service packages. This cost efficiency enables you to allocate precious financial resources to other growth areas within your startup.

Why Choose a Startup-Focused CPA Firm?

Understanding the Specialist vs. Generalist Advantage

Understanding the difference between specialists and generalists can significantly impact your startup’s financial trajectory. A specialist CPA firm, with a sharp focus on startups, brings a wealth of knowledge and experience tailored to your unique challenges and growth stages. They anticipate and navigate the financial complexities that are specific to startups with precision. Generalist firms, while experienced, may lack this laser-focused expertise, potentially leading to a one-size-fits-all approach. Choosing a specialist assures that the financial guidance you receive is as innovative and forward-thinking as your startup.

The Impact of Industry Expertise on Financial Strategies

Your startup’s financial strategy can soar with the help of a CPA firm that possesses in-depth industry expertise. Such firms understand the financial ebbs and flows specific to your market, allowing them to provide more accurate forecasts and tailored advice. Whether it’s navigating tax nuances or understanding typical investment cycles, industry-focused CPAs can position your finances in a way that gives you a competitive edge. The right expertise can also arm you with insights to secure funding and manage investor relations effectively.

Making an Informed Choice: What to Look for in to Find the Best Online CPA Startup Services

Analyzing the Range and Scalability of Services Offered

When examining online CPA services, it’s crucial to consider not just the immediate range but also the scalability of services they offer. As your startup grows, your financial needs will evolve; the online CPA service you choose should be able to grow with you. Look for those that offer a suite of services from basic bookkeeping to sophisticated financial modeling. Scalability means that as your business complexity increases, your CPA service can effortlessly ramp up the support, providing continuity and deepening their understanding of your business.

Case Studies: Success Stories of Startups and Their CPA Partners

Immersing into case studies reveals the tangible benefits of successful partnerships between startups and their CPA partners. These success stories often highlight innovative problem-solving, adept financial navigation during critical growth phases, and the harnessing of strategic tax incentives like R&D credits. They showcase how astute financial advice led to substantial savings, or how meticulous bookkeeping attracted investors. These narratives not only inspire but also serve as a compass for best practices in financial partnership.

Top Online CPA Services 2024:

www.Gettaxhub.com

When you explore Taxhub, you find a partner committed to easing the tax burden for startups. They shine by offering expert support for federal and state income tax filings, 1099s, and even niche areas like Delaware Franchise Tax filing. Why does Taxhub make the “best” list? They understand the vital need for organization and timely bookkeeping, and they equip you with a dedicated team attuned to your industry’s tax intricacies.

For startups seeking bespoke tax strategies and impeccable bookkeeping support, GetTaxHub.com is an outstanding partner for accelerator stage, pre-seed and seed stage startups.

www.Pilot.com

Navigating to www.Pilot.com, you discover a robust partner designed explicitly for startups needing accounting, bookkeeping, and CFO services. Why is Pilot a standout choice? Their first-hand startup experience translates into a deeply empathetic approach to financial management, and they offer a range of services that scale with your business’s growth.

Best for startups ready to invest in high-quality, startup-centric financial guidance, who are seed stage or C-series stage

www.bench.co

At www.bench.co, startups find a haven of financial clarity and streamlined bookkeeping expertise. What makes Bench an exceptional choice? Their commitment to keeping your business finances crystal clear and simplifying the bookkeeping process makes it stand out, as expressed by satisfied clients. Bench is ideal for startups seeking a comprehensive financial overview without diving deep into the nuances of accounting themselves.

An excellent fit for startups that value straightforward, expert-driven bookkeeping and actionable financial insights to make informed business decisions. Bench is perfect for Smaller businesses with multiple employees.

www.zinance.io

At www.zinance.io, startups step into a domain where expert financial management converges with advanced technology, serving up a menu of intelligence-driven CFO services. Standout for its blend of technology and financial consultation, Zinance.io is an ideal option for startups looking to marry their financial planning with data-driven insights.

For startups crafting a future guided by meticulous, data-driven financial strategies, Zinance.io stands out as a forward-thinking ally. Zinance.io is best suited for seed stage startups

www.FlowFi.com

Entering the world of www.FlowFi.com, startups encounter a powerful ally focused on cash flow management and financial forecasting. FlowFi excels in creating a narrative around cash flow that aligns perfectly with the ebb and flow specific to fledgling businesses, making it an essential tool in a startup’s arsenal.

For startups intent on mastering their cash flow and capturing the full picture of their financial forecast, FlowFi.com is a standout choice. FlowFi is prefect for pre-seed stage companies

The Best Online CPA Services for Startups Do These 4 Things:

- Create accurate cap table showing investment services

- Properly account for convertible notes

- Set up appropriate ERP (Enterprise Reporting Process) from the start

- Proactively structure for income tax mitigation and investor optimization

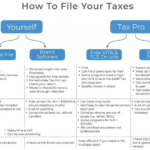

Deciding Between a startup accounting firm versus a tax filing service

When deciding between a startup accounting firm and a tax filing service, a founder should consider several key factors:

- Scope of Services: Accounting firms typically offer comprehensive services, including bookkeeping, financial analysis, and strategic advice, while tax filing services focus mainly on preparing and submitting tax returns. Startups with ongoing financial needs may benefit more from an accounting firm.

- Cost: Tax filing services are often more affordable, making them attractive to early-stage startups with limited budgets. However, accounting firms can provide value through broader financial management, potentially saving costs in the long run.

- Expertise: An accounting firm is likely to have more specialized expertise in startup finances, compliance, and growth-related issues, while tax services may be more transactional and suited for simpler tax needs.

- Customization: Accounting firms can offer tailored advice based on a startup’s specific business model and goals, whereas tax services are generally more standardized.

- Long-Term Relationship: An accounting firm can build an ongoing partnership with the startup, offering support year-round, whereas tax services tend to be seasonal and focused on tax deadlines.

- Compliance & Growth: If the startup expects rapid growth or complex financial issues, an accounting firm is better equipped to handle compliance and financial strategies.

The decision will depend on the startup’s financial complexity, budget, and need for ongoing advisory services versus one-time tax filing assistance.

FAQs: Essential Queries About Online CPA Services

What Makes Online CPA Services Suitable for Startups?

Online CPA services cater to startups by providing cost-effective, scalable, and flexible financial solutions. They utilize advanced technology for real-time insights and streamlined processes, offering the expertise startups need without the overhead of traditional firms. This suitability lies in their ability to adapt quickly to the evolving needs of dynamic startup environments.

How Can Online CPA Services Improve My Startup’s Financial Health?

Online CPA services improve your startup’s financial health by keeping accurate records, ensuring compliance, optimizing tax strategies, and providing strategic financial advice. By leveraging these services, you can avoid costly mistakes, make better-informed business decisions, and focus on growth without drowning in financial complexities.

Are There Customizable CPA Service Options for Different Startup Sizes?

Yes, most online CPA services offer customizable options tailored to the size and stage of startups. They provide scalable solutions, from basic bookkeeping for new ventures to comprehensive financial management for expanding businesses, ensuring that you receive the right level of support as your startup grows.

What Should I Expect to Invest in Quality Online CPA Services?

Expect to invest in quality online CPA services based on the complexity and volume of your financial needs, typically ranging from basic monthly subscriptions for bookkeeping to more substantial fees for advanced services like strategic planning and tax advice. Quality comes with an investment proportional to the services you require.

Comments