Navigate Taxes with Ease: Best Tax Accountant Hiring Guide

Navigate Taxes with Ease: Best Tax Accountant Hiring Guide

Navigating the Tax Season

The Role of Tax Accountants in Financial Health

Tax accountants are the navigators of the financial world, steering you clear of potential tax pitfalls and toward sustainable fiscal health. Good tax accountants delve beyond mere tax preparation, providing strategic advice that harmonizes with your financial aspirations. Whether devising investment strategies to optimize tax outcomes or steering you through the sea of tax credits and deductions, their expertise can be pivotal in enhancing your financial well-being.

Recognizing the Importance of Professional Help

Recognizing the importance of professional help for tax matters is akin to acknowledging the complexities of the tax code itself. As you face an ever-evolving landscape of rules and regulations, a professional tax accountant’s guidance can prove invaluable. They can help you not only comply with current tax laws but also prepare for future changes. This proactive approach can help mitigate risks and seize opportunities, ultimately protecting and maximizing your finances.

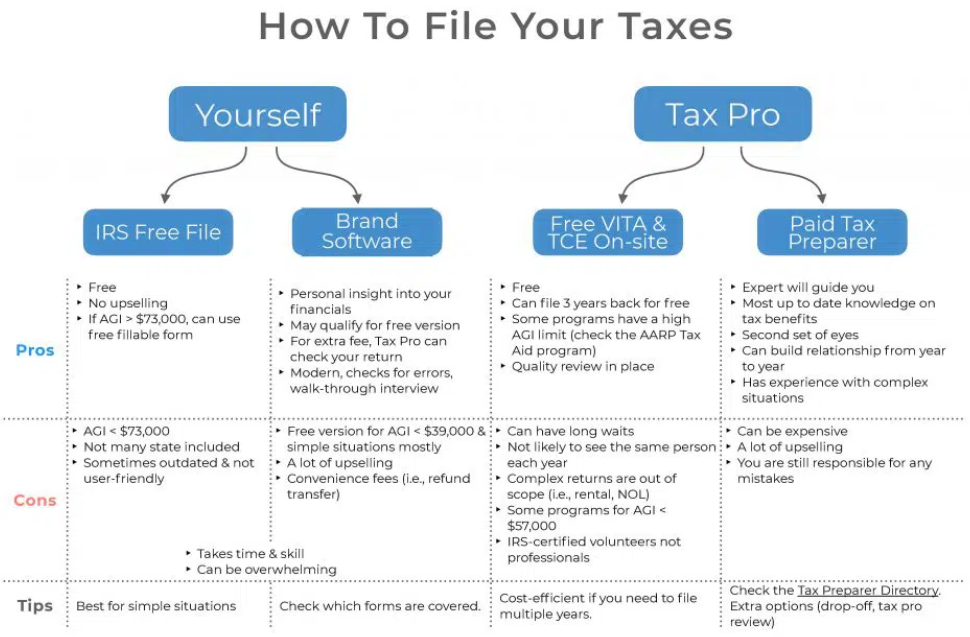

Assessing whether you should file taxes yourself or hire a professional

When assessing whether to file taxes on your own or hire a professional, consider the complexity of your tax situation. If you have a straightforward case, with sources like a W-2 and limited deductions, self-filing with free services might suffice. As your financial landscape broadens with investments, small business ownership, or significant life changes, seeking professional help is recommended. Remember, it’s not just about filing taxes; it’s about understanding the implications and planning for the future.

Understanding the Different Tax Professionals

CPA vs. Tax Accountant vs. Enrolled Agent

When navigating the distinct terrain of tax professionals, understanding the differences between a CPA, tax accountant, and enrolled agent is essential. CPAs, or Certified Public Accountants, are the elite with extensive training and a stringent licensing exam under their belt. They possess a breadth of knowledge in accounting and are well-equipped for complex tax scenarios. Enrolled Agents (EAs) boast specialized tax expertise, having passed a demanding IRS exam; they are adept at tax preparation and representation before the IRS. Tax accountants, while not always carrying the CPA or EA titles, offer valuable experience and should be certified to ensure they are up-to-date with the tax laws and can competently handle your tax needs.

Specializations within Tax Accounting

Tax accounting isn’t one-size-fits-all. Accountants often hone in on specialties, from corporate tax structures to personal income tax nuances. You may come across experts in realms such as estate taxes, international tax law, small business accounting, or niche sectors like the agriculture or non-profit space. These professionals have typically invested time and energy in gaining deep insights and staying current with regulations in their chosen areas, making them supreme assets when you face specific tax-related challenges.

Qualifications and Expertise

Education and Certification Requirements

There is no formal requirement to claim the mantle of a “tax accountant”. The gold standard in the world of accounting—becoming a CPA—requires at least 150 college-level credits and passing the robust Uniform CPA Examination. Keep in mind, requirements for CPA licensure can vary by state, so it’s crucial to research local mandates. For those who specialize in tax matters, earning an Enrolled Agent certification from the IRS represents an alternative pathway, focused on tax laws and regulations, and permits direct representation of taxpayers before the IRS.

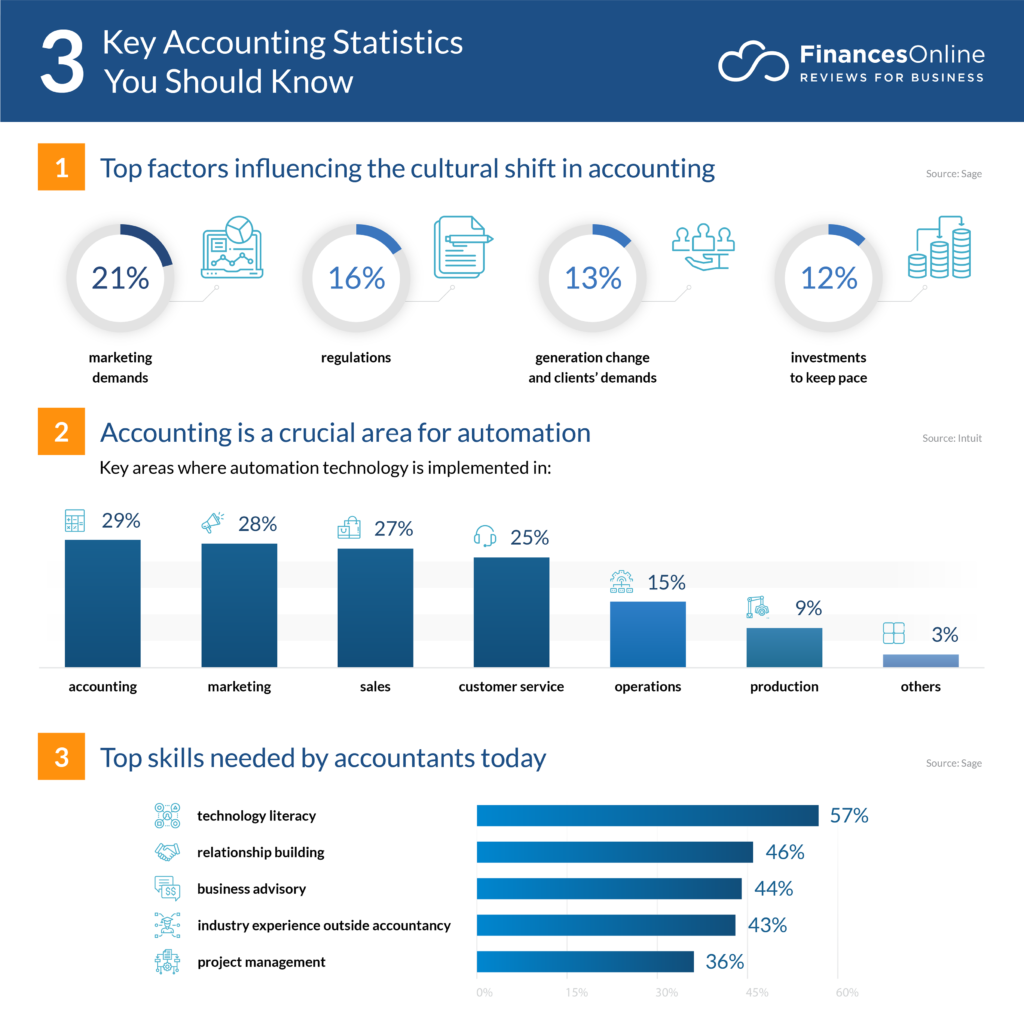

Essential Skills for a Competent Tax Accountant

A competent tax accountant is a blend of a sharp analyst and a meticulous record-keeper, seasoned with the foresight of a strategist. Paramount among their skills is an analytical mind, critical for interpreting complex tax laws and sculpting bespoke tax strategies. Robust numerical abilities allow them to accurately crunch numbers fast, a must-have during the high-pressure tax season. Precision is an important attribute, preventing costly errors on tax returns. They must also exhibit eloquent communication, translating tax jargon into digestible advice, and be organizational juggernauts to juggle multiple clients and looming deadlines seamlessly. A deep-seated knowledge of tax law and ethical standards further ensures they handle your sensitive financial data with utmost integrity.

How can I check a tax preparer’s credentials?

To ensure your tax preparer’s credentials are genuine, consider these steps. If dealing with enrolled agents, email the IRS at for verification at [email protected]. For certified public accountants, use the CPA Verify tool or contact your state’s board of accountancy. Tax attorneys should be vetted through your state’s bar association. Furthermore, professional organizations such as the National Association of Enrolled Agents (NAEA) offer directories of credentialed practitioners. To double-check a preparer’s claims, consult these databases or ask the preparer directly for proof of their qualifications.

[Placeholder for infographics with step-by-step instructions on using CPA Verify and contacting state boards for CPA and enrolled agent verification]

Top 4 Online Tax Accountants

Flyfin

Flyfin emerges as a futuristic choice for the tech-savvy taxpayer, harnessing the power of AI to streamline tax filing. It stands out for its revolutionary approach, offering a hassle-free experience for those who embrace digital solutions. Strong in its appeal for freelancers and the self-employed, its key features include real-time expense tracking, deduction identification, and on-demand assistance from tax experts.

Top 5 Features:

- AI-powered expense tracking

- Real-time deduction identification

- Access to certified tax experts

- Seamless integration with bank accounts

- Diverse filing options accommodating to various tax situations

Benefits:

- Saves time with automated processes

- Maximizes deductions ensuring you pay the minimum taxes necessary

- Provides expert guidance tailored to individual needs

- Simplifies tax management for individuals with complex finances

- Allows for easy tax filing from anywhere

Cons:

- May feel less personal than a traditional tax consultant

- Could be overwhelming for those less comfortable with technology

Best For: Flyfin is particularly suited for freelancers, gig workers, and those with a knack for technology who seek an efficient and modern way to manage taxes.

Keeper Tax

Keeper Tax positions itself as a guardian for gig workers and freelancers, diligently working to uncover oft-missed deductions. This platform aligns with the needs of modern independent workers, offering seamless tracking of work-related expenses throughout the year and simplifying the otherwise arduous task of tax preparation. It’s like having a vigilant tax assistant in your pocket, always on the lookout for savings.

Top 5 Features:

- Automated expense tracking for 1099 contractors

- Personalized deduction discovery

- Direct filing through the app

- Integration with numerous financial institutions

- Continuous tax support and education resources

Benefits:

- Saves money by capturing easily overlooked deductions

- Cuts down on manual record-keeping

- Streamlines the tax preparation and filing process

- Provides access to expert tax advice

- Educates users about tax benefits specific to freelancers and independent contractors

Cons:

- Mainly tailored to 1099 income, which might not suit all tax filers

- Automated tracking may miss nuances that require human analysis

Best For: Keeper Tax is ideal for independent contractors and gig economy workers keen on maximizing their deductions without delving into the nitty-gritty of tax laws.

Taxhub

Taxhub takes the online tax preparation experience a step further with its blend of technology and personal touch. It promises the conveniences of remote tax services coupled with the assurance of face-to-face interaction, thanks to its video conferencing model. Ideal for those who want more engagement than a phone call or email but still prefer the comfort of home for their tax dealings.

Top 5 Features:

- Virtual face-to-face meetings with tax professionals

- Secure document upload and management

- Hands-off service — just upload documents and Taxhub does the rest

- CPA review of all tax returns

- Flat-fee pricing without the need for an office visit

Benefits:

- Provides a personalized consultation experience virtually

- Eliminates the need to visit a physical office

- Ensures accuracy with CPA oversight

- Transparent pricing model helps users budget for tax services

- Aids in building a trusting relationship with tax professionals

Cons:

- Some may prefer in-person interaction for complex tax issues

- Limited to those comfortable with virtual meeting platforms

Best For: Taxhub is best suited for taxpayers who value the traditional accountant-client dynamic but are also inclined toward the accessibility and convenience of modern technology.

The Collective

The Collective takes aim at the specific needs of freelancers, independent contractors, and solo entrepreneurs, offering a combination of tax, legal, and financial services under one roof. As a holistic financial wellness platform, it integrates seamlessly into the lives of self-employed professionals who require an umbrella service to manage varying aspects of their business affairs.

Top 5 Features:

- Bundled tax, accounting, and legal services

- Personalized financial advice for self-employed individuals

- Direct access to specialized accountants and lawyers

- Monthly subscription model for ongoing support

- Exclusive focus on self-employed professionals

Benefits:

- Streamlines financial management by consolidating services

- Offers targeted advice relevant to freelance business structures

- Facilitates long-term planning with consistent professional relationships

- Helps to anticipate and address legal and tax issues proactively

- Alleviates the stress of dealing with multiple service providers

Cons:

- Monthly subscription cost may be higher than standalone services

- Specific focus might not appeal to those outside the target demographic

Best For: The Collective is particularly advantageous for freelancers and solo entrepreneurs seeking comprehensive, continuous financial care tailored to the intricacies of self-employment.

Cost vs. Benefit Analysis

Understanding Fee Structures and Service Value

Peering into fee structures is paramount in deciphering the value you receive from a tax service. Tax accountants can bill by the hour, offer a flat rate per return, or sometimes charge based on the tax form’s complexity. Scrutinize what’s included: will they provide year-round advice, audit support, or just the essentials? Assessing the scope of services against the fees will help you weigh whether the investment translates into true value for your specific tax needs.

Studies on average tax savings from using a tax accountant

Recent studies have highlighted that individuals and businesses often reap financial benefits from employing a tax accountant’s services. These benefits are attributed to the professional’s ability to identify deductions, credits, and strategic tax planning opportunities that may otherwise be overlooked. On average, the precise savings can vary widely based on the complexity of the tax situation and the accountant’s expertise, but the consensus supports the notion that a knowledgeable tax professional can provide significant savings.

Long-Term Benefits of Professional Tax Assistance

Professional tax assistance is not just about immediate tax return gains; it’s an investment in your long-term financial health. Benefits include strategic planning to align with future tax law changes, reducing the likelihood of errors and audits, and crafting a progressive tax strategy to optimize your wealth going into retirement. These professionals become your financial allies, helping you make informed decisions that could benefit your financial situation for years to come.

Making the Final Decision

Assessing Fit and Assurance

Assessing fit and assurance with a prospective tax accountant involves gauging their understanding of your financial picture and your comfort level with their expertise and working style. Ensure they are not only qualified but also genuinely interested in your financial goals. An accountant who asks probing questions and offers clear explanations is a promising sign of a good fit. Trust and communication are foundational — you must feel assured they will handle your finances with the same care they would their own.

When to Trust Your Instincts

When it comes to choosing a tax accountant, trust your instincts alongside factual assessments. If you experience unease or doubt after initial consultations, it could be a warning sign. A good fit feels right: you should sense a rapport, a level of comfort discussing financial matters, and confidence in their competency. Positive gut reactions are often validation of your due diligence, so pay attention to them.

The Future of Tax Accounting

Technological Integration and Automation Trends

The tax accounting field is experiencing a significant shift with the integration of technology and automation. Cloud-based software, AI, and machine learning are transforming how tax data is processed, leading to increased accuracy and efficiency. These tools also empower tax professionals to offer more strategic, data-driven advice. Clients benefit from faster service and often, lower costs due to reduced manual labor.

Continuing Education and Adaptability in Tax Law

The ever-evolving nature of tax law demands that tax accountants commit to a path of lifelong learning. The most adept professionals proactively seek continuing education through courses, seminars, and webinars to keep their knowledge razor-sharp. This dedication not only sustains their relevance but ensures they can pivot with legislative changes, offering clients the most current and strategic tax advice.

Rise of Online Tax Accountants

The ascent of online tax accountants represents a paradigm shift in how tax services are delivered. Convenient, often cost-efficient, and highly adaptable, these digital-age specialists offer tax assistance through innovative platforms, making professional advice accessible from the comfort of home. Their rise reflects a growing demand for flexible, tech-driven tax solutions in a fast-paced world.

FAQ’s About Hiring a Tax Accountant

What qualifications should I look for in a tax accountant?

For a tax accountant, seek out a robust educational foundation typically evidenced by a bachelor’s degree in accounting or a related field. Credentials are key: a CPA or EA designation assures a regulated level of expertise. Verify experience, licensure, and a history of ongoing education to handle the complexities of tax law adeptly.

Should small businesses hire a tax accountant?

Yes, small businesses should consider hiring a tax accountant to navigate the complexities of business taxes, identify potential deductions, ensure compliance, and develop strategic tax planning. Professional guidance can save time and money, making it a wise investment for most small business owners.

Can I use online DIY resources to manage my taxes instead?

Certainly, online DIY resources and tax software can be viable for managing taxes, especially for straightforward financial situations. They offer convenience and may be cost-effective. However, for more complex cases or when specific expertise is needed, a professional tax accountant is highly recommended. For more information feel free to schedule a free 5 minute CPA call here at Tahub.

Comments